Should You Buy or Rent A Home in Today’s Market?

Does the rising cost of living have you thinking twice about buying a home? As a real estate expert in Northern Virginia with over 10 years of experience, this is my bread and butter.

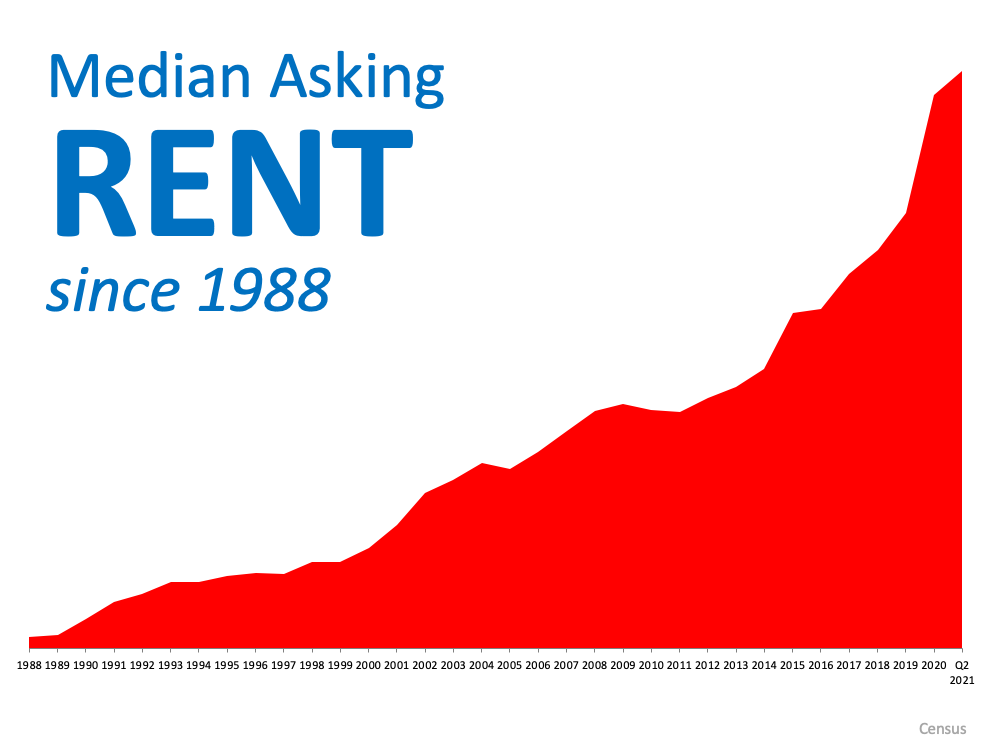

This graph shows the median asking rent since 1988. What stands out to me is how steadily it’s been rising each year. If you’re still renting, ask yourself how many times has your rent gone up probably every time you started a renewal lease. And as inflation rises, prices all around you are going to rise as well.

The rise in home prices may tempt you to buy rather than rent.

If rising home prices leave you wondering if it makes more sense to rent or buy a home in today’s housing market, consider this. It’s not just home prices that have risen in recent years – rental prices have skyrocketed as well.

That can be a hard pill to swallow. This means rising prices will likely impact your housing plans either way. But there are a few key differences that could make buying a home a more worthwhile option for you.

The good news:

When you buy a home, you can lock in your monthly payment for the length of the loan. Plus as you pay that loan off and home prices continue to appreciate, you gain equity that will help build your net worth. These two are the things renting can’t provide.

If consistent payments and growing your long-term wealth are important to you, homeownership should be too.

I can help you get there. I know what steps renters need to make to become homeowners.

Let’s connect today, and let’s start building your net worth.

Follow me on socials for more real estate tips and advice!